By: Wendy Foster, SBREC Business Adviser and Manager

Following on from Part 1 which looked at key elements of starting a business, this part will focus on financials, how to do them and why you need them.

Let’s start with that: why work out sales and cashflow forecasts? It’s to give yourself a solid understanding of where your business will make profit and to ensure your business has a healthy and robust financial standing. It allows you to identify areas you may need to cut back on or develop and help you work on your pricing strategy.

So, how to go about it? Let’s break it down into sections:

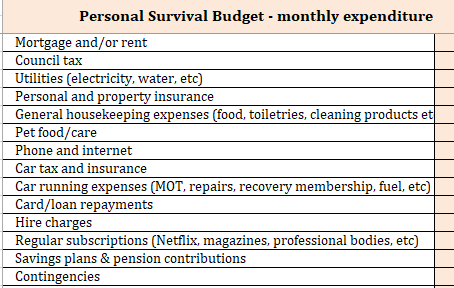

Personal Survival Budget

The name of this says it all really; it’s collecting detailed information on what budget you as an individual will need to live. Use a spreadsheet to write down these details, including your monthly rent/mortgage, council tax, utilities, but also how much you spend on food, toiletries, household cleaning products, pet care, dinners, drinks, cinema, etc. This latter group can be harder to work out accurately, but taking the time to do so will help you identify areas you may be able to cut back on whilst getting your business off the ground. For example, takeaway coffees may be delicious, but might it be something that can be cut back on? With price increases, it doesn’t take too many of these to really add up and if that’s the case, then it is a potential saving [relatively] easy to make.

Tip: if you can bear it, note absolutely every penny you spend and do it for 2 months as no two months are the same and this will give you more of an average.

Startup costs

Every business will incur some startup costs, although this will vary greatly depending on industry. You might be looking at costs for equipment, premises, recruitment, or it may be just insurance, licensing or an initial promotional/marketing push. Use a spreadsheet to note down everything that you need to have in place before you can start generating income. This not only helps you understand what you’ll be spending before you earn anything but will also allow you to identify if you need more funds to get your business off the ground.

Tip: sense-check this with someone, in case they can think of something you’ve missed.

Funding

Once you’ve worked out how much money you need then you will be in a good position to decide whether to bootstrap it or look for a business loan or equity investment. Research is key for this to make sure you choose the best option for your business.

Tip: if you borrow from friends and family, put a written agreement in place so that you are both on the same page and don’t fall out from remembering things differently from each other.

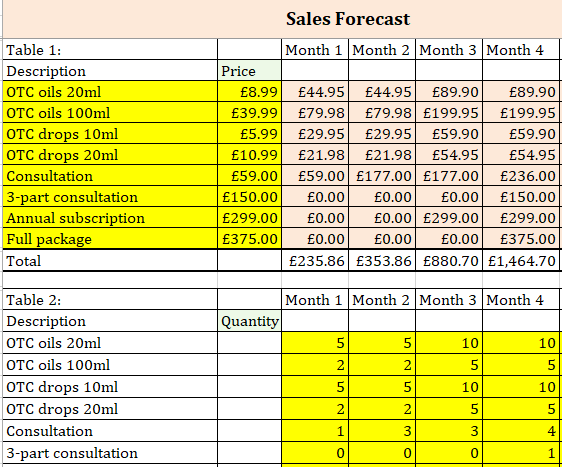

Sales forecasting

When you’re new to business, this is a really tough question. The positive to say here is that you are most definitely not alone, everyone goes through this. That doesn’t of course help in practical terms, but hopefully reassuring to know you’re not alone.

A useful starting point for your sales forecast might be to look at what prices your competitors are charging, whether it is a product or service, and if you already have experience in your industry’s pricing structure then note that down also. Pay attention to individual unit prices and also special offers and create lists of prices that could correspond to your offer. However, do not base your pricing solely on this method as competitors may have lower prices than you will need.

Once you have a starting point, add this to your financial forecasting spreadsheets where you can combine your sales forecast with your cashflow forecast. Seeing the balance of financials once you do this can help give direction to whether or not you need to increase pricing, units sold, focus on the higher profit margin units, or whether you need to have a broader rethink.

Tip: this is one of the harder parts of forecasting, so take your time to do it carefully and expect to have to rejig this quite a lot from your starting point. Most people find this very difficult, so be patient with it and yourself.

Cashflow forecasting

The term ‘cash’ in budgets does not mean just literal cash, but digital monies also, ie what you have in your business bank account and online transactions. Cashflow is helping you identify the ‘flow’ of cash into and out of your budget throughout the year, giving you an understanding of the wealth of your business; divided into two sections, income and expenditure. If you’ve used a template, then your more detailed sales forecasts should appear as a single figure in the receipts/income box. You add to this any other income, including business loans.

Underneath that, add in all your expenses, month by month for the year. Some of these will be fixed and therefore straightforward to enter, such as loan repayments, broadband and business premises rent, and others will be more flexible such as marketing, printing and accountancy costs. The combination of income and expenditure will give you the balance, allowing you to identify the best times to potentially spend more on things such as a marketing push. It also gives you an understanding of when you might have quieter times with less income. This is hugely beneficial as it makes you aware that you shouldn’t spend everything you have as it comes in because you’ll need to even it out across the year making sure your balance remains healthy at all times

Tip: check carefully the cost of things you add, such as any outsourcing you may do for things such as marketing, packaging, professional services, etc, so that your figures are as accurate as possible.

General tips when working on your financials

- Be realistic. Don’t put in sales figures you ideally want without information and evidence to back up your assumptions. Most businesses will take a while to build their brand awareness, so don’t presume you’ll be making thousands in your first few months.

- Regularly revisit both your sales and cashflow forecasts.

- Plan ahead. This gives you a better position for negotiating costs or finding different suppliers of products or services if necessary.

- Seek support. Don’t think you have to do it all by yourself, there may be people out there who have been on your journey that can help, including business mentors.

Moving forward:

- Email the Small Business Research & Enterprise Centre (SBREC) if you would like their template for financial forecasting. There are also many available online, but make sure you find a UK one as others may have different terminology and different currency settings!

- Become a free member of the Small Business Research & Enterprise Centre to get [free] remote access to the Cobra database which contains advice and tips on sales, cashflow and much more.

- Attend the Business Blueprint course running in October. Find out more and buy your ticket! There’s a £5 discount for SBREC members, so if you’re a member please email us for the discount code.